By Rachel Gass – 4/30/25

Unpacking the 2025 Annual Energy Outlook

What is the Annual Energy Outlook?

The Annual Energy Outlook (AEO) is an independent analysis published by the U.S. Energy Information Administration (EIA) that projects long-term trends in energy consumption and supply in the United States. Notably, the EIA is one of the only government agencies worldwide to report such detailed statistics on a regular basis, making the report a key decision-making tool for governments, industry leaders, trade associations, and other planners in the public and private spheres.

The EIA crafts the AEO by using the National Energy Modeling System (NEMS) to project a set of scenarios representing a range of possible outcomes for the U.S. energy system over the next twenty-five years. Importantly, these forecasts are not predictions but rather modeled projections of what could happen given certain assumptions and methodologies. Projections reflect a business-as-usual path given known technological and demographic trends and current laws, with alternative cases assuming future policy changes.

Limitations of Prior Models

Decision-makers widely anticipated the release of AEO2025 due to announced modeling system enhancements and the introduction of new modules designed to improve the report’s utility in analyzing future energy trends.

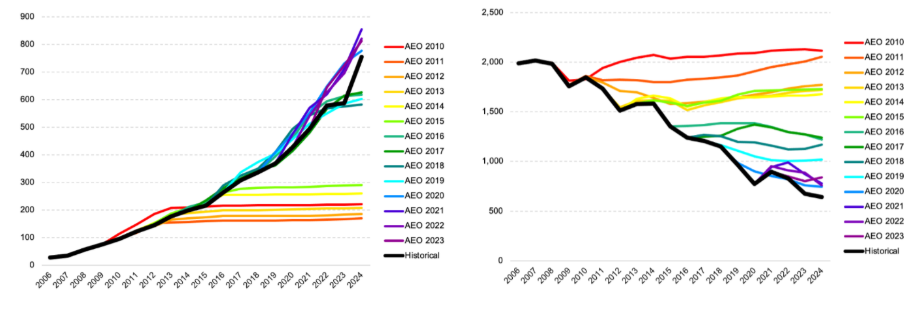

Prior reports’ limitations in estimating the mid-term potential for both higher- and lower-carbon energy production reveal the importance of these improvements: earlier reports severely underestimated projected wind and solar output due to an unstable clean energy legislative landscape, while later reports overestimated mid-term deployment due to interconnection queue backlogs and pandemic-delayed energy infrastructure production.

Prior models also missed key trends in greenhouse gas emissions: from 2005 to 2022, the U.S. saw a 39% decrease in carbon dioxide emissions per megawatt-hour of power generation, but the AEO overestimated power generation by heavy polluting energy sources. These misalignments poorly equipped policymakers to accurately integrate trends into policy deliberations, highlighting the importance of enhanced modeling and case variety.

Updates to AEO2025

To address prior limitations, the EIA added modules to their integrated energy-economy modeling system and included updated end-use demands, technology cost projections, and changes in policy. AEO2025 is also the first to use a captured energy approach for noncombustible renewable energy generation, compared to the fossil fuel equivalency of prior models. Consistent with international statistics standards, this convention more accurately reflects how electrifying end-use energy consumption and increasing renewable market penetration decreases the need for thermal-based primary energy sources.

AEO2025 contains a set of eight core side cases and two alternative policy cases. This overview will focus primarily on two of those scenarios: the policy-neutral Reference case and the Alternative Electricity case. Based on laws and regulations as of December 2024, the reference case serves as an experimental control modeling nominal conditions. The Alternative Electricity case, which assumes the removal of some Biden-era regulations, more closely maps the policies expected under the new administration. When used in tandem, these cases provide useful points of comparison across a range of outcomes.

AEO2025: Findings

AEO2025 is significantly abridged compared to previous iterations: the report contains only a short introductory narrative and a full set of data tables but includes no figures or results narrative. Joseph DeCarolis—the former EIA administrator during the previous administration—provided some insight to these changes in his comments on Bluesky, saying that the outlook was published “under difficult circumstances,” with the office “subject to the same churn happening across the federal government.”

Accordingly, much of the results narrative that follows has not been sourced from the EIA website but provided by DeCarolis himself following the release of the report. Overall, these findings suggest a continued, albeit slower, energy transition, even if the new administration succeeds in repealing or reducing the IRA.

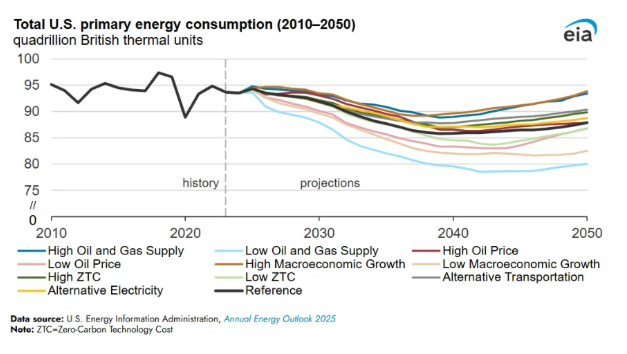

- Most broadly, AEO2025 projects total energy consumption to decline through 2040 before increasing again due to improvements in efficiency and the report’s refined methodology. Efficiency improvements include electrification of end-uses and updated equipment emissions standards.

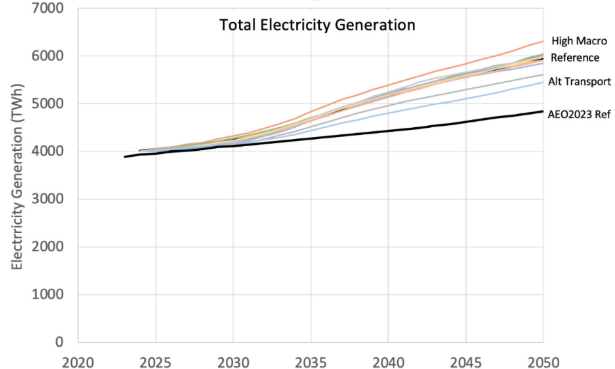

- Both the policy-as-usual Reference scenario and Alternative Energy case project a 50% increase in U.S. electricity generation by 2050, from approximately 4,000 terawatt-hours (TWh) to 6,000 TWh, due to the electrification of end uses and increases in existing sources of energy demand. Electrified transport has a significant impact on electricity demand: by 2050 there is a projected 500 TWh difference between the Reference and Alternative Transport scenarios, the latter of which assumes no federal standards encouraging EV adoption.

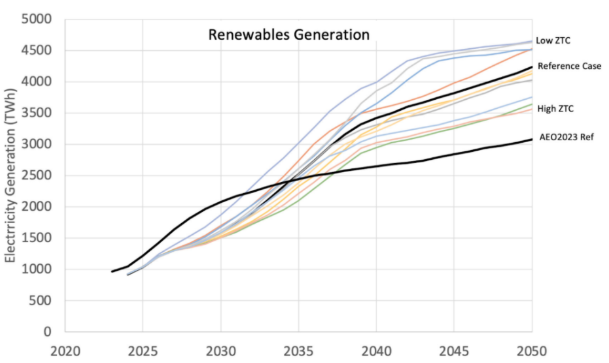

- The Reference scenario projects significant growth in renewable energy generation, from 1,000 TWh in 2025 to 4,000 TWH in 2050. This is a significant jump from the 2023 report, which projected a little over 3,000 TWh of renewable generation in 2050.

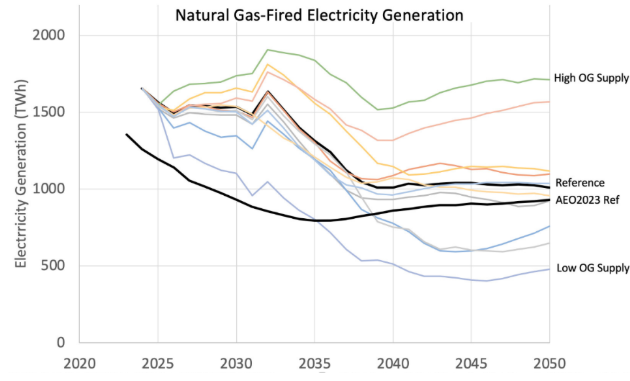

- Both the Reference and Alternative Energy scenarios show natural gas generation declining over time, with renewables increasingly composing the generation portfolio. The Alternative Electricity scenario projects gas-fired generation to stall around 1,000 TWh from 2040 onwards.

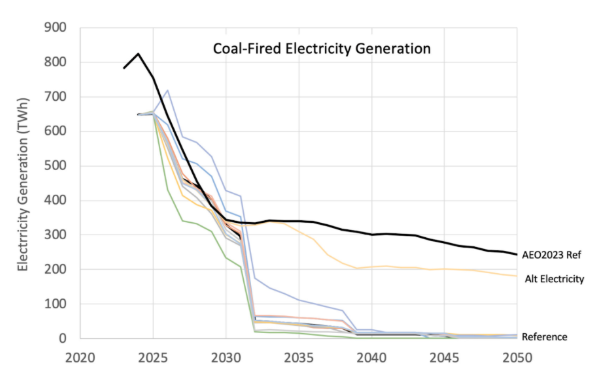

- Coal generation is also expected to decline, with the Reference scenario projecting its near disappearance by 2034 due to EPA regulations, and the Alternative Electricity scenario projecting it to level out around 200 TWh after a sharp ten-year decline.

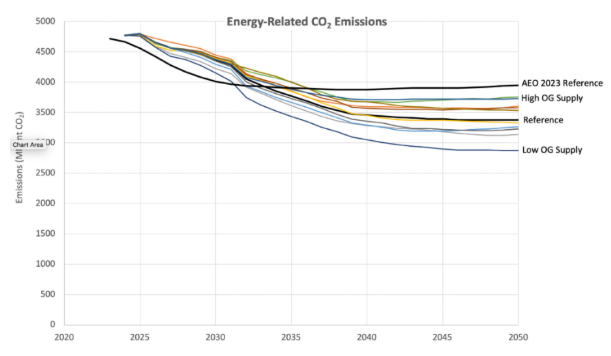

- The Reference scenario projects energy-related CO2 emissions to be 17% lower than in AEO2023, largely due to the IRA, EPA regulations, and the dropping costs of renewables and batteries. However, across all scenarios, emissions tend to flatline around 2040 as IRA credits expire and energy demand is projected to grow.

- Finally, the Reference scenario projects an increase in electricity prices from 13 cents per kWh in 2024 to more than 20 cents per kWh by 2050, consistent with recent trends in capacity cost jumps driving rate increases across the country.

Response and Future Outlook

The release of AEO2025 has been met with criticism by the federal government, who issued a statement calling the report’s findings “disastrous” for American energy production because they predict a shift away from natural gas towards renewables. Although renewables are domestically produced and align with the current administration’s stated goal of supporting American-made energy, the administration is a vocal opponent of investment in renewable energy, preferring to support high-carbon sources like coal and natural gas instead.

These critiques align with the administration’s broader stance towards programs they deem nonessential. Since January, the EIA has been slammed with massive workforce cuts, with over 40% of its employees departing or accepting buyouts. Over 100 more employees are set to leave in the coming weeks.

As a result, the future of the AEO remains unclear. Remaining staff are reportedly evaluating which EIA reports they will be able to continue producing moving forward, while many research initiatives have been placed on indefinite hold. The EIA’s website now lists the release date of the next annual outlook as “TBD,” leaving energy market participants wondering when, or if, they will receive such crucial energy data in the future.