By Lilly Price & Rachel Gass – 7/31/25

What’s Driving the Price of Renewable Electricity Bills?

Renewable energy is increasingly cheaper to produce, often cheaper than fossil fuels. Yet as energy prices rise in our region, many consumers are left wondering why clean electricity is still usually more expensive to buy than its polluting counterpart.

Clean energy has the potential to be a much lower-cost source of electricity. Unlike fossil fuels, which require ongoing extraction and processing, the “fuels” for renewables such as wind and sunlight are free and ubiquitous. As a relatively new set of technologies, the cost of building systems to harness clean energy has also dropped rapidly. In 2024, 91% of new large-scale renewable energy generation projects worldwide delivered electricity at a lower cost than the cheapest new fossil fuel generators.

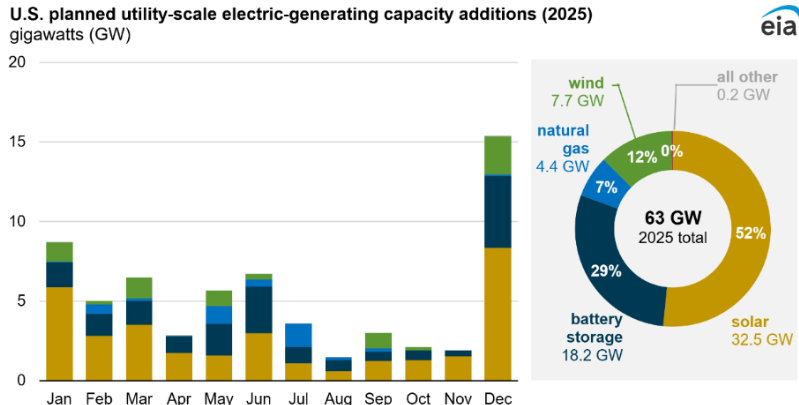

Energy storage, long one of the biggest barriers to widespread adoption, has also become far more affordable. Storage costs have dropped by half since 2010. As a result, clean energy capacity is growing quickly. In 2014, 53% of new electricity generation capacity came from wind, solar, or batteries. By 2025, that figure had reached 93%, according to the U.S. Energy Information Administration.

U.S. Energy Information Administration, Preliminary Monthly Electric Generator Inventory, December 2024

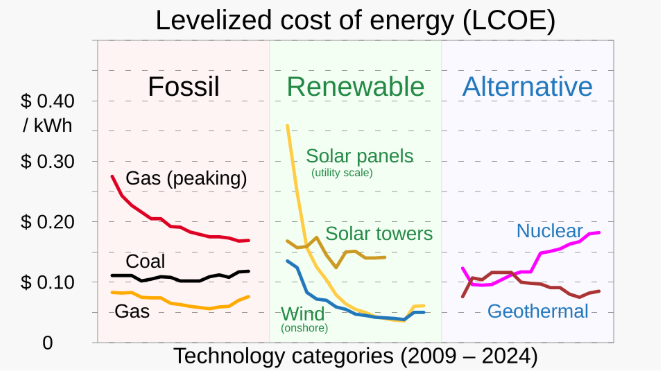

Another way to compare costs is through the Levelized Cost of Energy (LCOE) metric. LCOE represents the minimum price at which electricity must be sold for an electricity production project (like a solar farm or coal-fired power plant) to recover its construction and operating costs over its lifetime. By standardizing costs across technologies with different upfront investments and lifespans, LCOE allows governments, businesses, and investors to compare energy generation technologies and determine which are most cost-effective and worthy of pursuing.

By this popular measure, wind and solar now frequently undercut coal and gas, even without subsidies. In many cases, the low-end cost of new wind and solar, including storage for reliability, is cheaper than simply keeping an existing gas plant running. This sends a strong signal to developers, which is why the vast majority of new developments connecting to the grid use renewables.

Levelized cost of energy (LCOE) estimates for various energy sources. Source: Lazard LCOE+ Version 16 (2024), graphic by RCraig09 via Wikimedia Commons.

Despite these trends, renewable energy often remains more expensive for consumers. The reasons lie not in the cost of producing clean energy, but in how electricity markets are structured, the physical realities of the grid, and the failure to account for the true costs of fossil fuels.

ENERGY MARKET DESIGN & STRUCTURAL ISSUES

Wholesale market: Energy is sold on the wholesale market on a real-time or hourly basis. In Pennsylvania, this market is managed by PJM, the regional grid operator. PJM collects electricity offers from different generators and selects the lowest-cost options to meet demand throughout the day. PJM continues to select electricity offers in order of cheapest to most expensive until supply matches demand.

The final and most expensive source selected sets the market price for all generators. This source is usually a natural gas plant. As a result, even though wind and solar power are cheaper to produce and are typically dispatched first, they are paid the same market price as fossil fuel generators. This structure allows fossil fuel prices to drive overall electricity costs. You can read a more detailed blog post about how natural gas impacts renewable electricity prices here.

Prices also spike during periods of peak electricity use. Fossil fuel power plants can burn more fuel to ramp up output quickly and capitalize on higher prices. Solar and wind sources may or may not be able to ramp up output due to weather factors, which disadvantages clean energy sources in the market.

Capacity market: Power generators receive payments not only for the electricity they produce today, but for the capacity they promise to have available in the future. The capacity market is designed to ensure short- and long-term electricity supply by rewarding sources that can respond quickly when demand spikes. This system strongly favors fossil fuel generators, which can generally deploy on short notice, making them eligible for payment for most of their nameplate capacity. Renewable sources, on the other hand, face limits and penalties because their energy output is harder to predict. As a result, renewable plants are often capped at selling only 10% to 38% of their nameplate capacity, significantly limiting their revenue.

As electricity demand grows, capacity payments make up an increasing share of generator revenue. Renewable generators cannot benefit from this system to the same extent as fossil fuel generators. The cost of these limitations affects all energy consumers —especially renewable energy consumers — in the form of higher bills. See this previous blog post for more details.

Interconnection queue & permitting: Adding more renewable energy to the grid would help reduce costs overall, but new projects must first navigate a lengthy approval process. PJM’s interconnection queue now stretches for years, creating uncertainty for developers and slowing the pace of new clean energy projects. These delays limit competition and allow older fossil fuel plants to maintain their dominant market position. Cheaper renewable resources are kept off the grid longer, preventing them from driving down prices.

Renewable energy credits: Another contributor to higher consumer prices is the cost of renewable energy credits, or RECs. Each REC represents one megawatt-hour of renewable electricity delivered to the grid. RECs ensure that when consumers purchase renewable energy, an equivalent amount of clean generation is produced. In Pennsylvania, RECs are relatively expensive because the state produces less renewable energy than demand requires.

In addition, all suppliers must purchase a second category of credits for lower-impact, though not necessarily clean, energy sources. While this policy is meant to push fossil fuel suppliers toward cleaner options, it adds another layer of costs for providers that already supply 100% renewable electricity.

PHYSICAL & TECHNICAL BARRIERS

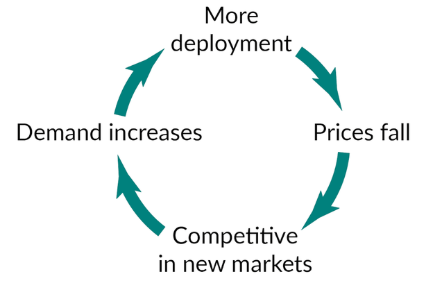

Learning curve: New technologies tend to follow a predictable pattern. Costs fall rapidly during early development and then level off as technologies mature. Fossil fuel technologies reached this plateau decades ago. Renewables are still earlier in the process, which means we can expect continued cost reductions in the future. For example, wind energy costs in newer markets like the U.S., Japan, and South Korea are expected to fall another 40% in the next decade, while fossil fuel energy costs are not expected to decline.

Learning curve and technology adoption feedback loop. Data from Our World in Data / Max Roser (December 1, 2020); graphic published under CC BY 4.0 via Wikimedia Commons.

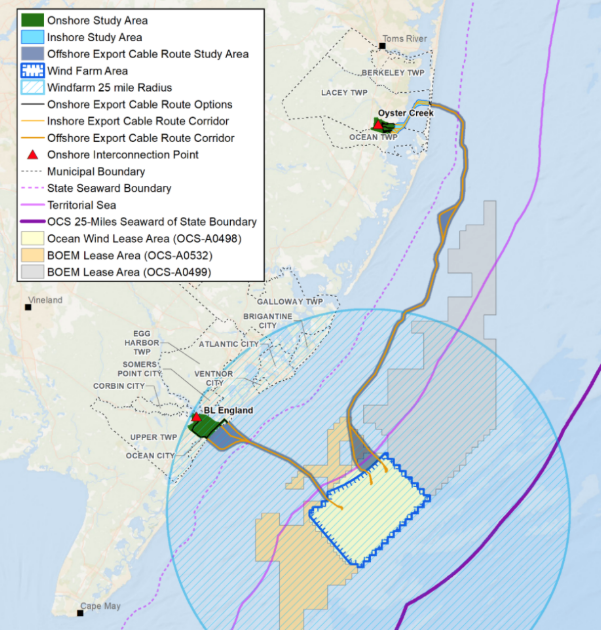

Infrastructure inertia: Fossil fuel plants are typically located near cities and already have the specialized infrastructure needed to deliver large amounts of power to the grid. Renewable energy projects, on the other hand, often need to be built in remote areas, which requires new and costly transmission infrastructure to bring them online. Bringing this power to consumers requires new transmission lines, which are expensive and politically complex.

Transmission projects involve many stakeholders and often face local opposition, environmental review hurdles, and regulatory delays. These challenges can stall renewable development. Recently, a federal loan guarantee for massive transmission lines intended to carry wind power from the Midwest to the grid-stressed eastern U.S. was canceled, highlighting the obstacles to bringing more affordable clean energy online and reducing energy costs.

Supply chain issues: Major obstacles in renewable energy supply chains include limited access to critical materials, heavy reliance on overseas manufacturing, and global shipping delays for large components like wind turbine blades or special components with long production cycles like gearboxes. Trade tensions and shifting industrial policies further complicate access to materials and equipment, making supply chains a major factor in how quickly clean energy can scale. In 2023, developers canceled plans for two major wind farms that would have powered roughly half a million homes, highlighting the effect supply chain obstacles have on renewable energy buildout.

Map showing the planned electrical interconnections for Ocean Wind 1. Source: Bureau of Ocean Energy Management, via Ocean Wind 1 Final Environmental Impact Statement (May 26, 2023); public domain U.S. federal government image.

EXTERNALITIES & POLICY GAPS

Externalized costs: Fossil fuels often appear inexpensive because their environmental and public health impacts are not reflected in their market price. Pollution, climate damage, and health effects are largely borne by the public. There is no comprehensive policy that fully accounts for these harms.

Renewable energy avoids many of these costs, making it cheaper from a broader societal perspective. Researchers have attempted to estimate the social cost of carbon, which represents the economic damage caused by each ton of carbon dioxide emissions. One widely-cited meta-analysis estimates this cost at $112.86 per ton.

In our region, that translates to about 3.6 cents per kilowatt-hour, or roughly $23.55 per month for a typical household using 700 kWh. If these costs were reflected in electricity prices, the difference between fossil fuels and clean energy would be far more visible. This estimate also excludes other dangerous pollutants and greenhouse gases beyond carbon dioxide.

Despite market, policy, and technical barriers, renewable energy continues to advance rapidly. Its ability to compete under these conditions highlights both how far clean energy has come and how much room remains for improvement.

We are not there yet. Today’s electricity markets still favor fossil fuels in many ways. This is where consumers matter. Every person who chooses renewable electricity helps shift demand, support new infrastructure, and move the energy system toward greater fairness and sustainability.

Those extra few dollars? They’re not just covering the cost of power. They’re an investment in the future of the planet and people across the world. Choosing clean energy helps build a more livable future for everyone.